Did You Exit After Brexit?

Saturday, August 6, 2016 at 12:55PM

Saturday, August 6, 2016 at 12:55PM The pundits had it all wrong with the Brexit vote (I too was wrong on the British vote to exit from the European Union).

With the benefit of hindsight, we can see that it would have been a bad idea to sell your stock holdings after the Brexit vote; you would have locked in a 5% to 10% loss in a market that has trended upward to new record highs. The same is true of the aftermath of the World Court decision that slapped China in the face by declaring that man-made islands don’t transform an ocean into territorial waters, the attempted coup in Turkey, or, really, any other alarming headline which doesn’t materially affect a company’s ability to run its operations or earn a profit.

But the bigger issue is that, even if you knew the outcome of the vote, you still wouldn't have known how markets were going to react. How would you know whether quick-twitch traders would buy or sell the event? After the Brexit vote, it took a weekend for investors and traders to realize that this was Britain’s problem, not theirs. Realistically, it could have taken a month, or even a year to play out.

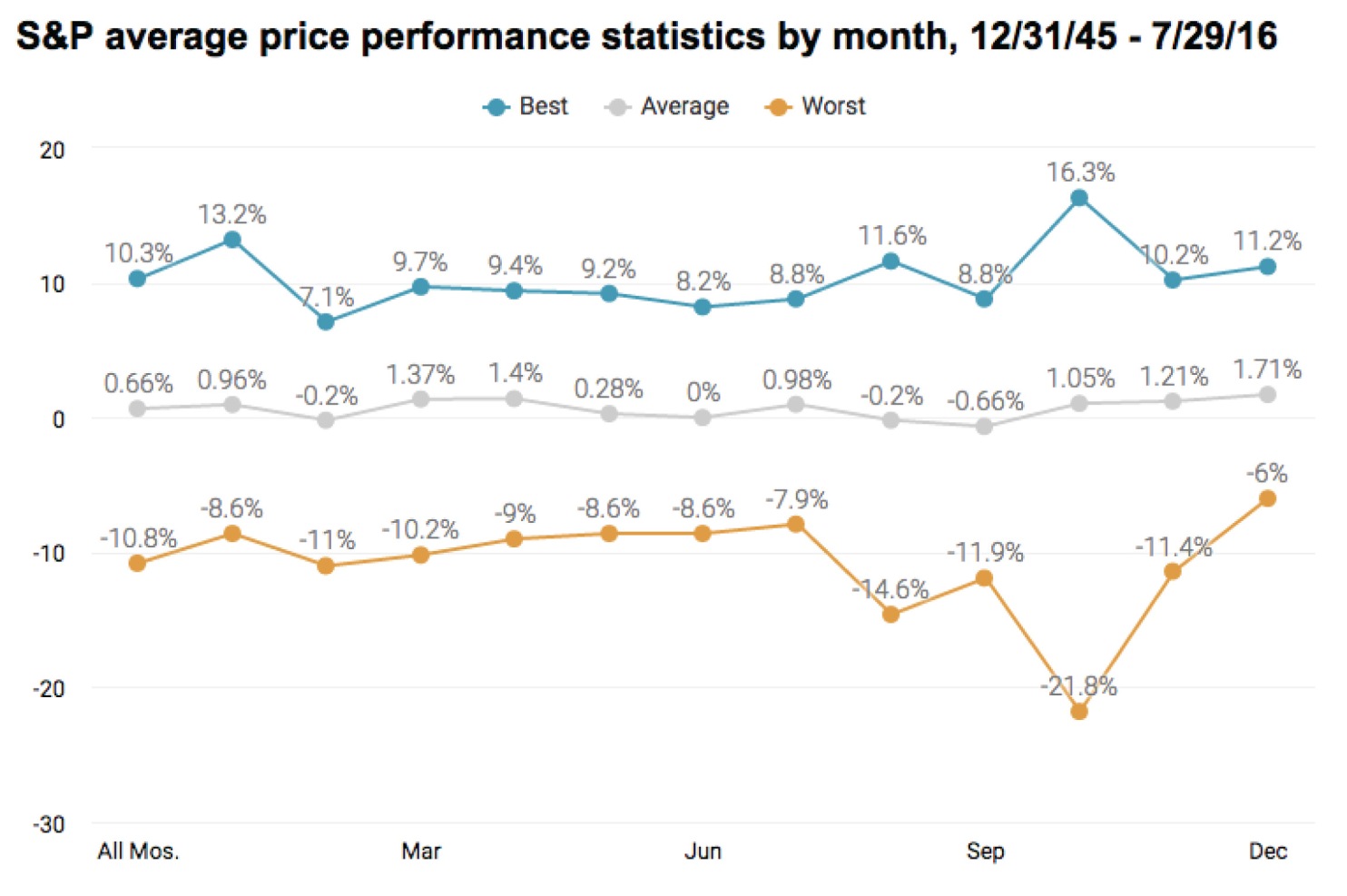

The same is true for the time period that we’re heading into now. As you can see from the accompanying chart, the average return for various months of the year has been pretty much the same across the spectrum. But August, September and October have seen bigger highs and (most alarmingly) also deeper lows, on average, than other months. This additional volatility seems to be random, and is, once again, impossible to time. People who decide to side-step the late summer and early fall would miss out on average yearly gains for September and October of 1.05% and 1.21%. (Skipping August would have saved you modest losses of less than 1%, on average, but one suspects that this is a statistical anomaly.) The month of August in election years, even during the bear market of 2008, tends to have a positive bias; will this year be one of them?

Finally, biggest picture of all, the current bull market, which started March 9, 2009, has now become the second-longest bull market on record, beating the June 1949 to August 1956 rally. It is second only to the December 1987 to March 2000 advance. In terms of percentage change, we are experiencing the fourth strongest bull market on record.

Doesn’t that mean it’s time to take our chips off the table? If we knew how to consistently time the market, if we could be sure that the market run won’t continue to run up for another few years, then the answer would be yes. But with the economy continuing to churn out positive gross domestic product (GDP--the measure of our output of goods and services), with inflation low and unemployment continuing to fall, and central bankers supplying liquidity and stimulus to the markets, it’s hard to see what would cause U.S. stocks to be less valuable in the near future than they are today.

Meanwhile, once again, even if we did exit, how would we know when to get back in? Investors who bailed during the 2008 downturn missed much of the surprise upturn that began this current bull run. Those who hung on more than made up for their losses, even though it seemed like every year would be the bull market’s last. One thing that I've learned from doing this for so long, is that moves in the market (in both directions) usually go on far longer than most people can imagine.

There isn't a day where some market "expert" or pundit comes out and says he likes nothing in this market and to sell everything? ... Really?? Sell everything?! It angers me how reckless these statements are. Giving blanket advice to people is irresponsible. You don’t know the person’s goals, age, risk tolerance, time-frame, etc. But fearful headlines will always attract eyeballs, and most of these pundits have something to sell you. Don't buy it. Maybe you should sell some things, but always do your own due diligence and always keep in mind your long-term goals.

It’s nearly certain that there will be a lot of scary headlines between now and the end of the year, and it’s quite likely that the investment roller coaster is about to get bumpy. All of us wish that we had a working crystal ball to help us navigate through uncertainty, but all we have is the historical record, which says that after the next downturn, the market will eventually experience a new high (yes, this will happen regardless of who becomes our next president). We want to be there to celebrate it.

If you would like to review your current investment portfolio or discuss any other financial planning matters, please don’t hesitate to contact us or visit our website at http://www.ydfs.com. We are a fee-only fiduciary financial planning firm that always puts your interests first. If you are not a client yet, an initial consultation is complimentary and there is never any pressure or hidden sales pitch. We start with a specific assessment of your personal situation. There is no rush and no cookie-cutter approach. Each client is different, and so is your financial plan and investment objectives.

Sources:

https://www.washingtonpost.com/business/get-there/given-the-brexit-brouhaha-how-did-your-investments-hold-up/2016/07/22/a7bc1198-4d03-11e6-a7d8-13d06b37f256_story.html

http://www.investmentnews.com/article/20160801/FREE/160809992/if-history-is-a-guide-market-volatility-is-about-to-spike

http://www.cnbc.com/2016/07/13/merrill-second-longest-bull-market-ever-has-further-to-run.html

The MoneyGeek thanks guest writer Bob Veres for his contribution to this post