With ten days to go in the 2nd calendar quarter and the end of the first half of 2022, we’ve witnessed one of the worst yearly starts in the markets since 1962 with a decline of about 23% in the S&P 500 index. This makes this year the 3rd worst start for the index in market history.

The good news? Of the fourteen other worst starts to the year since 1931, ten of them went on to turn in positive returns for the rest of the year, although only five of those fourteen years turned things around and closed with positive returns for the entire year.

Mid-term election years (the 2nd year of a president’s term) have historically been lackluster, but that doesn’t entirely explain why this year has been so awful. Of course, the same culprits outlined in my What’s Going on in the Markets May 8, 2022 newsletter are still front and center today: 1. The war in the Ukraine; 2. Rising inflation; 3. Higher interest rates. A resolution in any of these three culprits could send the markets on a big trek higher.

To be fair, the markets were rife with speculation in all manners of stocks, special purpose acquisition companies (SPACs), initial public offerings, crypto-currencies, non-fungible tokens (NFTs) and other insane valuations of art, homes, antiques, etc. Most of this rampant speculation was fueled by the unprecedented fiscal and monetary stimulus unleashed in the markets by the Federal Reserve and Federal Government to combat a potential economic depression caused by COVID-19. As happens most often, a pendulum that swings too far in one direction must swing too far in the other direction to correct the excess. That’s the nature of cycles-both economic and markets.

From the pandemic low in March 2020 to the high in January 2022, the S&P 500 index more than doubled (+108%), so a market that moves that far in less than two years would historically be expected to give back (retrace) some of those gains at some point. To most students of long-term markets, giving back 50% or more of those gains would not be unusual at all before the uptrend might resume. At a closing level of about 3,678 as of last Friday, that would take the S&P 500 index to around 3,500, about 5% lower than Friday’s close. Nothing says it must stop there, but that level historically would be expected to generate at least a decent bounce or short-term rally.

Adding insult to injury, this has also been one of the worst starts in over 40 years in the bond markets. Long adding ballast to portfolios and a relative haven from the stock market storms, bonds on average are down over 12% year-to-date, with long term treasuries down over 24%. Even 1–3 year treasury bills are down about 3.7%, making even the safest and shortest of duration government bonds not immune from the carnage. Of course, when bond prices decline, their yields increase, so they become more attractive for new investments.

The perfect storm of a bond and stock market decline means that there have been few places to hide, other than energy and commodity stocks. Of course, energy and commodity stock outperformance mean higher prices for goods, which is at the heart of the inflation problem we now have.

Inflation Marches Higher

When so much stimulus enters the economy and markets in a short time, inflation inevitably rears its ugly head. Think of fiscal and monetary stimulus as money printing, and you can quickly understand how adding so many dollars to the money supply would tend to de-value those dollars. Indeed, when the inflation numbers were released for April and May (8.6% and 8.4% consumer price index respectively), they were higher than expected. Relief in the supply chain logjam was not enough to offset the increased cost of labor, energy, and commodities (mostly raw materials and foodstuff).

Obviously, inflation at this level cannot be sustained longer term and needs to be tamed before it crashes the economy as consumers begin having trouble affording necessities, let alone discretionary purchases. It’s one of the two mandates of the Federal Reserve (The Fed): to reel in inflation using the tools at their disposal to prevent an economic crash.

Interest Rate Hikes

The dual mandates of The Fed are to:

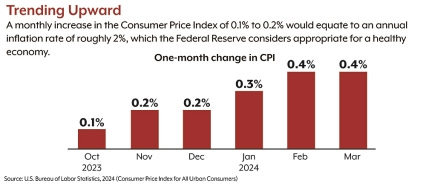

1. Maintain price stability (by keeping inflation to 2% or less) and,

2. Ensure maximum employment.

With unemployment at historic lows, maintaining price stability is currently job #1 for The Fed.

When the pandemic hit, you may recall that The Fed immediately reduced short-term interest rates from 2.25% to 0% to counter the expected economic contraction effects of the COVID-19 pandemic. They also launched one of the biggest asset purchase plans (bond buying) in history as an emergency measure to ensure enough liquidity in the financial system to keep the economy and commerce from seizing up. The Fed kept these asset purchases up through March of this year (far longer than necessary in my opinion), thereby flooding the markets with stimulus.

Beginning in April, The Fed raised short term interest rates by 0.25% for the first time and announced that the bonds bought over the past several years would be sold off over time. Of course, if injecting the markets with all that stimulus and maintaining low interest rates props the markets up, withdrawing that liquidity and raising interest rates should have the exact opposite effect--and of course it has.

The Fed followed up with a 0.5% and 0.75% short term interest rate hike in May and June respectively, bringing the short-term rate to around 1.5%. During the June meeting, The Fed telegraphed that a further 0.5% or 0.75% interest rate hike could be forthcoming in July (and future months) if inflation doesn’t ease in the coming month. Of course, with inflation running over 8%, The Fed, with short term interest rates around 1.5%, is still woefully behind the curve. Many pundits and critics want them to move much faster to tame inflation.

Low interest rates (near 0% for over two years) represent “cheap money” to individuals and companies, encouraging investment, spending, borrowing, and of course speculation. All of that tends to make for an overheated economy, pushing prices higher. Raising interest rates tends to curb the demand for capital and overall spending, thereby reducing pressure on the supply of goods and services, and in turn, reducing pressure on prices. But by doing so, The Fed risks pushing the economy into a recession.

Recession or Soft Landing

The Fed has acknowledged that lifting interest rates may curb consumer and corporate demand enough to push the economy into a recession. Fact is, it’s possible that we’re already in a recession but don’t know it yet.

The textbook definition of a recession is at least “two consecutive calendar quarters of negative gross domestic product or GDP.” For the first quarter of 2022, the economy did register a negative GDP of 1.3%, and the second quarter could potentially register a similar small negative GDP. As of Friday June 16, the Atlanta Federal Reserve lowered GDP estimates for the 2nd quarter to about 0%, which means that it could easily turn negative by the end of the quarter, putting us into a an official recession.

Regardless of how the 2nd quarter plays out, textbook recession or not, I would expect that any recession would be another mild or short one (like the short-lived COVID recession of 2020) as we try and squeeze out much of the excesses brought on by the post-COVID over-stimulus. While you’re likely to be bombarded (and scared witless) by the news media about how the economy has officially fallen into a recession, it remains to be seen how long and how bad it might get. With housing and employment still strong, and corporate earnings holding steady, (albeit weakening somewhat with everything else), the recession should prove to be mild or moderate in my opinion.

What To Do Now

The market is currently in what I would characterize as “no-man’s land”. That’s to say that it’s too late to sell and yet probably too early to buy. As mentioned above, we have the potential to visit the 50% retracement level of S&P 500 at 3,500, 5% lower from here. But the selling was so intense last week, that could be considered somewhat exhaustive, or capitulatory as some refer to it in the business. While bad things tend to get worse in the markets before they get better, the proverbial rubber band to the downside is firmly stretched, meaning that a strong snapback rally could start as early as tomorrow, if not later this week or next.

In a mid-term election year, we tend to see a summer rally from late June into mid-July, with weakness or sideways movement persisting throughout the August-October period. But post-election, a year-end relief rally into the spring tends to be strong. So unfortunately, any relief rally in June/July may prove fleeting, with much better probabilities for a long-term rally coming in the 4th quarter. Of course, this is all crystal ball prognostication, relying on history to project future returns. This should not be relied on to make investment/portfolio decisions.

So, what about nibbling at stocks and stock funds (and even bonds) with the market down so much? While dollar cost averaging over time has a successful track record, the key is your own personal discipline to continue investing at regular intervals and knowing that it may take months or years to become profitable on new buys, especially if this market doesn’t find a bottom until late this year or next.

Those who bought in mid-2008 thinking that the bottom was in found out that they had to endure another 30% drawdown until the ultimate bottom in March 2009. In the end, this all turned out great for long term holders, albeit with a little pain.

If you are confident that you won’t sell everything if the market continues lower and reach your own capitulation point, there’s nothing wrong with nibbling on names that have come down to attractive levels. Personally, I prefer to see signs of strong demand returning from large institutions, something that is still absent at these levels. The path of least resistance, as of today, is unfortunately lower, but that could easily change in a day or two of strong buying.

For our client portfolios, we came into the 2nd quarter with one of our lowest allocations to stocks and bonds in years. We continue to be hedged with cash, stock options and bear market funds, and we continue to harvest profits and raise cash. If we see further weakness and no return of demand from institutions, we will further increase our hedges and continue to sell underperforming positions into any rallies that “peter out” in short order.

If you find yourself stuck in positions that no longer meet your initial criteria for buying them in the first place, consider using upcoming rallies to sell them (even at a loss) and upgrade your portfolio with better performing companies at the right time. Instead of big bites, take little nibbles, and keep in mind that bear market rallies are very good at sucking in investors and convincing them that the selloff is over, only to roll over and make lower lows. This is not a recommendation to buy or sell any security.

No one knows how deep the market will pull back. Have we seen the lows, or do we have some ways to go? I personally think we may have seen the worst of it, but that’s just a gut feeling. That doesn’t mean that I believe that the sell-off is over. Similarly, we have no idea if the next rally will mark the bottom of this pullback or just be another “suckers’ rally”.

In the end, these somewhat painful periods always end, paving the way for a new long-term uptrend (a.k.a., a bull market). As I always echo, investing in the stock market is great for long term returns, as long as you don’t get scared out of it at the wrong time. After all, enduring volatility is the price we pay for outsized long-term returns. Be patient and stay small with buys to keep your risk in line with your own tolerance.

If you would like to review your current investment portfolio or discuss any other financial planning matters, please don’t hesitate to contact us or visit our website at http://www.ydfs.com. We are a fee-only fiduciary financial planning firm that always puts your interests first. If you are not a client yet, an initial consultation is complimentary and there is never any pressure or hidden sales pitch. We start with a specific assessment of your personal situation. There is no rush and no cookie-cutter approach. Each client is different, and so is your financial plan and investment objectives.

Tuesday, August 6, 2024 at 10:05AM

Tuesday, August 6, 2024 at 10:05AM