The Impact of Higher Interest Rates on Real Estate

Friday, July 5, 2024 at 3:02AM

Friday, July 5, 2024 at 3:02AM At the beginning of March 2022, the U.S. 10-year Treasury Bill interest rate hovered around 1.8%. By January 2024, that same 10-year rate hovered around 4%, more than doubling in less than two years.

As a result, U.S. commercial real estate prices fell more than 11% between March 2022, when the Federal Reserve started hiking interest rates, and January 2024. The potential for steeper losses has chilled the market and still poses potentially significant risks to some property owners and lenders. (1)

On the residential side of the real estate market, the national median price of an existing home rose 5.7% over the year that ended in April 2024 to reach $407,600, a record high for April. (2) Despite sky-high borrowing costs, buyer demand (driven by younger generations forming new households) has exceeded the supply of homes for sale.

Here are some factors affecting these distinct markets and the broader economy.

Slow-motion Commercial Meltdown

The expansion of remote work and e-commerce (two byproducts of the pandemic) drastically reduced demand for office and retail space, especially in major metro areas. An estimated $1.2 trillion in commercial loans are maturing in 2024 and 2025, but depressed property values, high financing costs, and vacancy rates could make it difficult for owners to keep up with their debt. (3) In April 2024, an estimated $38 billion of office buildings were threatened by default, foreclosure, or distress, the highest amount since 2012. (4)

In a televised interview on CBS’ 60 Minutes in February, Federal Reserve Chairman Jerome Powell said the mounting losses in commercial real estate are a "sizable problem" that could take years to resolve, but the risks to the financial system appear to be manageable. (5)

Locked-up Housing Market

The average rate for a 30-year fixed interest rate mortgage climbed from around 3.2% in the beginning of 2022 to a 23-year high of nearly 8% in October 2023. Mortgage rates have dropped since then, but not as much as many hoped. In May 2024, the average rate hovered around 7%. (6)

The inventory of homes for sale has been extremely low since the pandemic, but a nationwide housing shortage has been in the works for decades. The 2005-2007 housing crash devastated the construction industry, and labor shortages, limited land, higher material costs, and local building restrictions have all been blamed for a long-term decline in new single-family home construction. The Federal Home Loan Mortgage Corporation, better known as Freddie Mac, estimated the housing shortfall was 3.8 million units in 2021 (most recent data). (7)

Many homeowners have mortgages with ultra-low rates, making them reluctant to sell because they would have to finance their next homes at much higher rates. This "lock-in effect" has worsened the inventory shortage and cut deep into existing home sales. At the same time, the combination of higher mortgage rates and home prices has taken a serious toll on affordability and locked many aspiring first-time buyers out of homeownership.

In April 2024, home inventories were up 16% over the previous year, but there was still just a 3.5-month supply at the current sales pace (a market with a six-month supply is viewed as balanced between buyers and sellers, but see the Latest Housing Data below.) The supply of homes priced at more than $1 million was up 34% over the previous year, which may help affluent buyers but won't do much to improve the affordability of entry-level homes. (8)

New Construction Kicking In

Newly built homes accounted for 33.4% of homes for sale in the first quarter of 2024, down from a peak of 34.5% in 2022 but still about double the pre-pandemic share. The growth in market share for new homes was mostly due to the lack of existing homes for sale. (9)

April 2024 was the second-highest month for total housing completions in 15 years, with 1.62 million units (measured annually), including single-family and multi-family homes. (10) This may cause apartment vacancies to trend higher, help slow rent growth, and allow more families to purchase brand-new homes in the next few months.

Renters are seeing some relief thanks to a glut of multi-family apartment projects that were started in 2021 and 2022 — back when interest rates were low — and are gradually becoming available. In the 1st quarter of 2024, the average apartment rent fell to $1,731, 1.8% below the peak in the summer of 2023. (11)

We don’t want to see a dramatic decline in the number of new multi-family housing projects just as rents are starting to ease. Reducing housing inflation is essential to paving a path toward lower interest rates, but rents could rise again if the new supply drops significantly.

Effects Weave Through the Economy

By one estimate, the construction and management of commercial buildings contributed $2.5 trillion to U.S. gross domestic product (GDP), generated $881.4 billion in personal earnings, and supported 15 million jobs in 2023. (12) According to the National Association of Realtors, residential real estate contributed an estimated $4.9 trillion (or 18%) to U.S. GDP in 2023, with each median-priced home sale generating about $125,000. When a home is purchased (new or existing), it tends to increase housing-related expenditures such as appliances, furniture, home improvement, and landscaping. (13)

Both real estate industries employ many types of professionals, and developing new homes and buildings stimulates local economies by creating well-paying construction jobs and boosting property tax receipts. The development benefits other businesses (locally and nationally) by increasing production and employment in industries that provide raw materials like lumber or that manufacture or sell building tools, equipment, and components.

Shifts in real estate values, up or down, can influence consumer and business finances, confidence, and spending. And when buying a home seems unattainable, some younger consumers might give up on that goal and spend their money on other things.

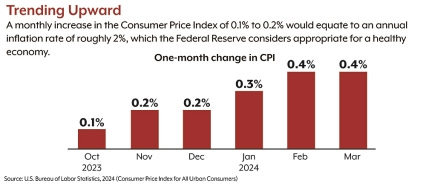

If interest rates stay high for too long, they could accelerate commercial loan defaults, losses, and bank failures, continue to constrain home sales, or eventually push down home values—and any of these outcomes would have the potential to cut into economic growth. When the Federal Reserve finally begins to cut interest rates, borrowing costs should follow, but that's not likely to happen until inflation is no longer viewed as the larger threat.

Latest Housing Data

The latest housing data shows we may have seen a cyclical high for the housing market.

For April, the S&P Case-Shiller 20-City House Price Index was up again, increasing by 0.4% on a seasonally adjusted basis, but below forecasts. While the Index is rising to new highs, home price growth is slowing.

May New Home Sales fell 11.3% from the previous month, and prices are now 9% below their October 2022 peak. The number of months’ supply of new homes for sale jumped, rising to 9.3 months, reflecting inventory levels only seen in some of the worst housing recessions of the last 50 years.

The housing market is starting to come back to earth. It is a major unknown how long it will take to normalize or how swift its fall. If new home sales data worsens and existing home supply increases further, prices will inevitably come down. We don’t want to see mounting evidence of a housing market plunge, which would majorly affect the broader economy.

If you would like to review your current investment portfolio or discuss any other retirement, tax, or financial planning matters, please don’t hesitate to contact us at 734-447-5305 or visit our website at http://www.ydfs.com. We are a fee-only fiduciary financial planning firm that always puts your interests first. If you are not a client, an initial consultation is complimentary, and there is never any pressure or hidden sales pitch. We start with a specific assessment of your personal situation. There is no rush and no cookie-cutter approach. Each client and your financial plan and investment objectives are different.

1, 3) International Monetary Fund, January 18, 2024

2, 8, 10, 13) National Association of Realtors, 2024

4) The Wall Street Journal, April 30, 2024

5) CBS News, February 4, 2024

6–7) Freddie Mac, 2022–2024

9) Redfin, May 20, 2024

11) Moody's, April 1, 2024